florida estate tax filing requirements

The actual exam has 100 questions and 3 12 hours is given to complete it. The parties or the court can modify these requirements except for the filing of a financial affidavit which is mandatory in all cases in which financial relief is sought.

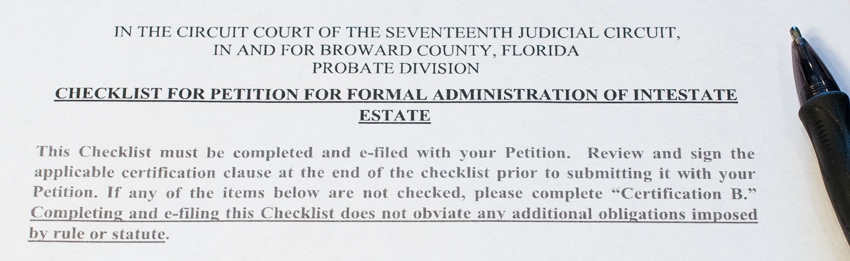

Florida Probate Rules Processes What You Need To Know

Provides that real estate owned by any quadriplegic is exempt from taxation.

. Vendors located outside the United States who do not have a federally issued Tax. May 02 2022 3 min read Appointing a Legal Guardian. Refund verification whats that.

Florida Business Tax Application Form DR-1. The Certificate of Registration. Estate and Inheritance Taxes.

Take this free Florida Real Estate Practice Exam to get an idea of the topics on the exam administered by the Florida Department of Business and Professional Regulation. Testamentary trusts would be subject to estate and gift tax rulesfiling requirements. Individual Income Tax Filing.

Box 6500 Tallahassee FL 32314-6500 Fax. Tax Filing Name. We are finalizing the sale and can no longer accept internet payments for 2021 real estate taxes.

This does have some requirements that must be met however. Between the parties the court may distribute the marital estate fairly or equitably not necessarily equally between the parties regardless of how title is held. 850 656-0528 Toll-Free Fax.

To do business with the State of Florida vendors must create a vendor account in the MFMP Vendor Information Portal VIP. Where a grantor trust has been established generally no gift tax would be due on property contributed. Florida divorce law provides a process called a Simplified Dissolution of Marriage Couples can use this to get a quick divorce about 30 days from filing to finalization as long as they have complete agreement on the terms of the divorce and its uncontested.

For more information about these reporting requirements consult with your Cherry Bekaert tax advisor or contact Anne Yancey the Firms State Credits Incentives leader. As a registered sales and use tax dealer a Certificate of Registration Form DR -11 and a Florida Annual Resale Certificate for Sales Tax Form DR -13 will be mailed to you. Our tax certificate sale commenced on 06012022.

Federal Tax ID. Contact your CPA or tax preparer for information on filing out of state tax returns once you become a Florida resident. In situations where an Inter Vivos irrevocable trust is the recipient of property contributed a gift tax return would generally be due.

P aper tax returns will be mailed to you unless you are filing electronically. Proof of filing a state return as a part time or non-resident may be required when updating your exemption qualifications. We anticipate completing this process by 06132022 at which time internet payments will be accepted.

State of Florida Applicable Laws - Florida Statutes 695012. Living trusts can be excellent estate planning tools but they arent necessarily going to protect your assets. Appraisers Parcel ID Number - The parcel identification number of the Property Appraiser must be included on the quitclaim deedEvery appraiser is given a parcel ID number by the city or county and this number or a blank space for the number to be filled in must be included.

An LLC that is taxed as a partnership is subject to the same federal income tax return filing requirements as any other partnership. Florida Quitclaim Deed Laws. Power of Attorney and Tax Information Authorization.

Helpful info for our newest Pinellas County citizens. Florida New Hire Reporting Center PO. To register vendors will need the following information.

The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

How Your Estate Is Taxed Or Not

U S Estate Tax For Canadians Manulife Investment Management

Florida Homestead Exemption How It Works Kin Insurance

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Pin On After Death Things To Do

Florida Probate Rules Processes What You Need To Know

Florida Property Tax H R Block

Should I Put My Florida Homestead In A Living Trust

Florida Fl Sales Tax And Individual Income Tax Information

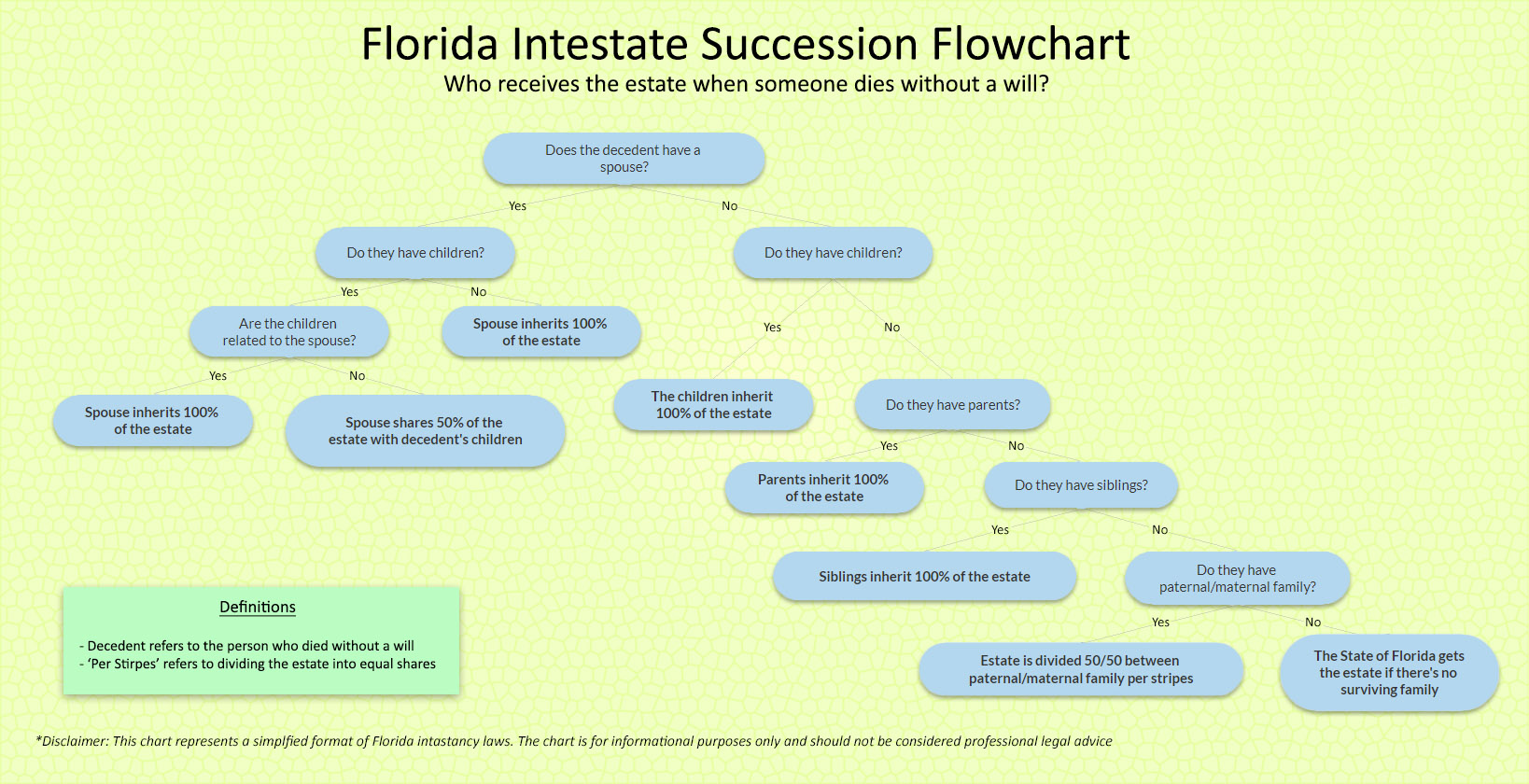

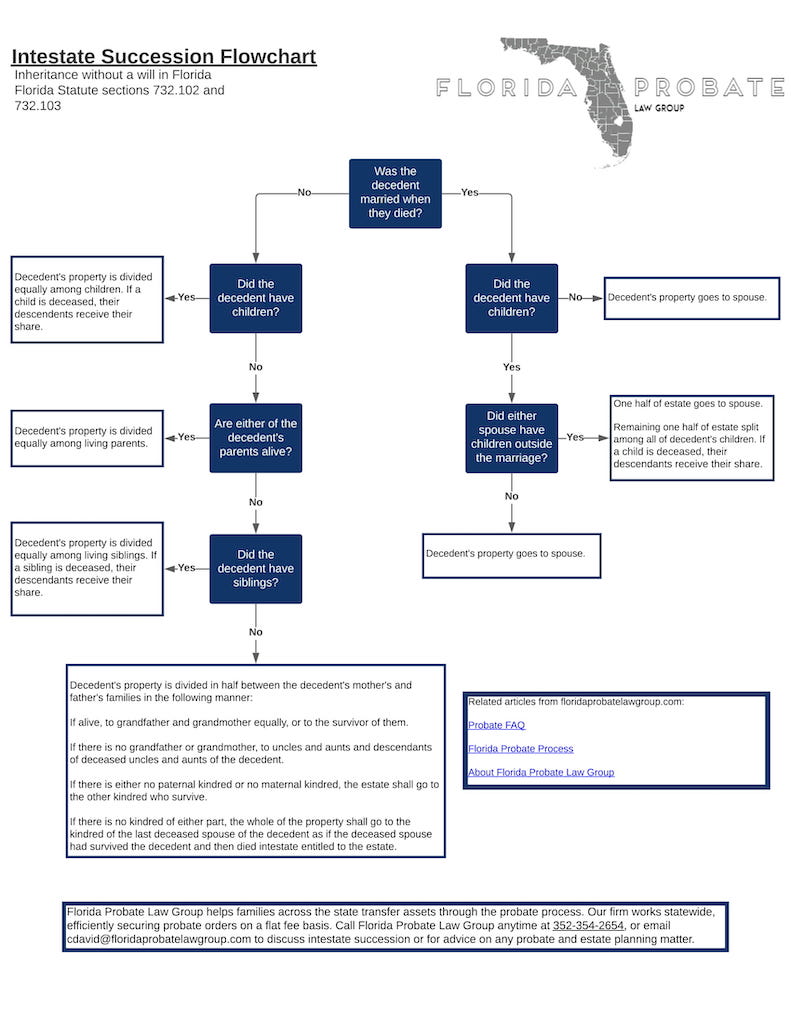

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

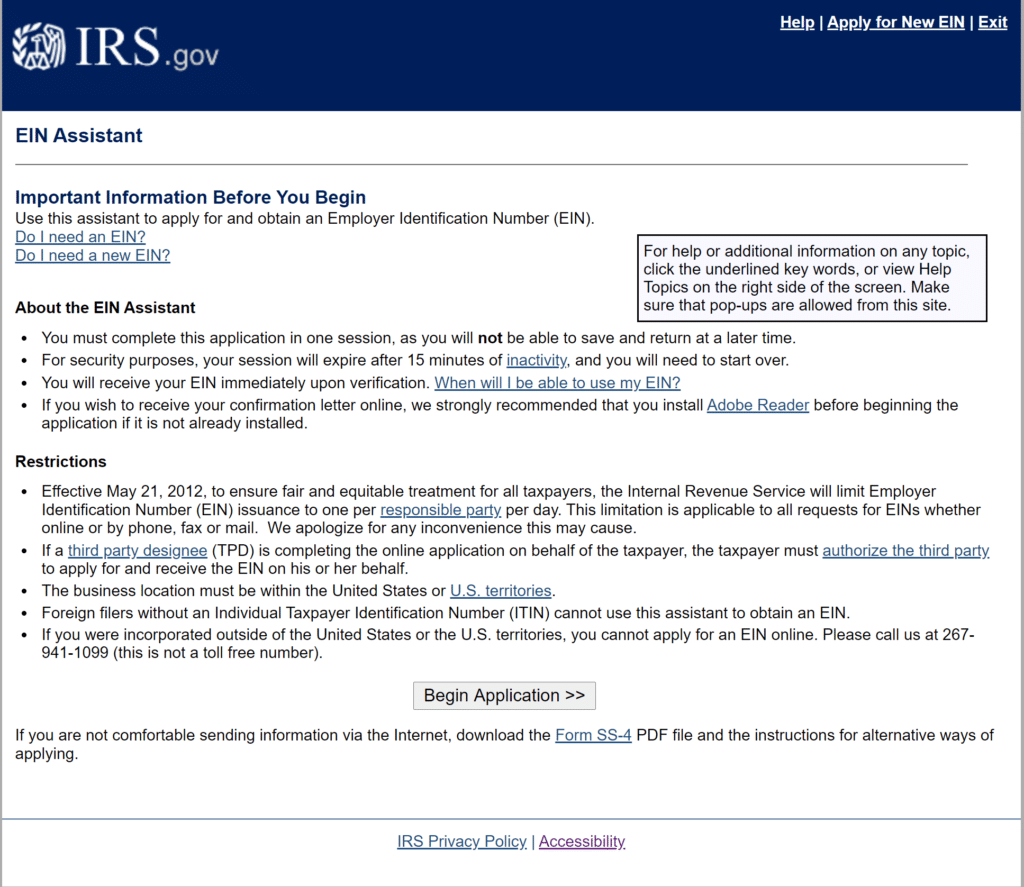

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Lexisnexis Automated Florida Probate Forms Lexisnexis Store

Eight Things You Need To Know About The Death Tax Before You Die

Florida Real Estate Taxes What You Need To Know

Florida Tax Information H R Block

It May Be Time To Start Worrying About The Estate Tax The New York Times

Florida Gift Tax All You Need To Know Smartasset

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022